|

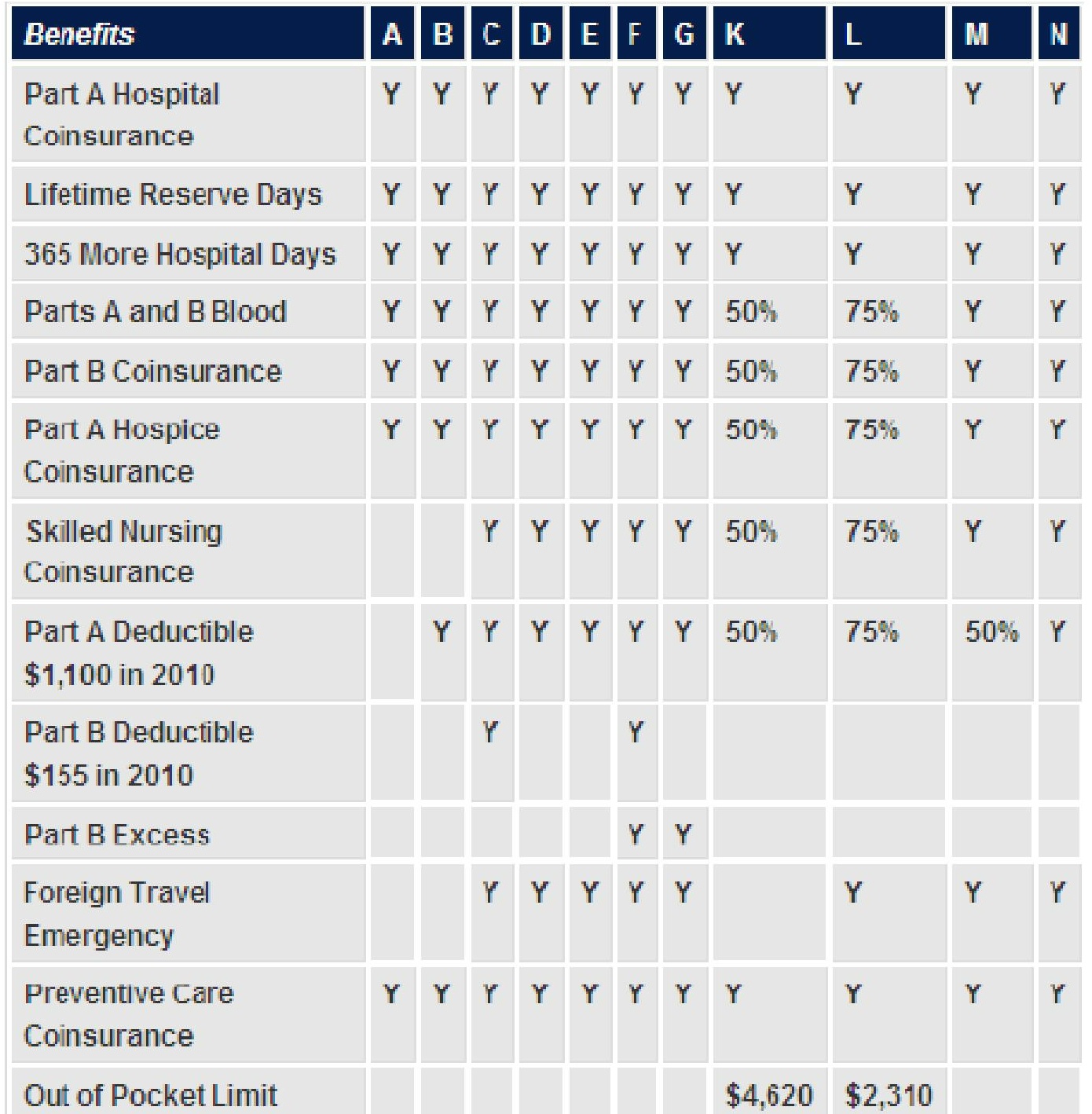

Medicare Modernization Act of 2010 New Medicare Supplement Plans and Changes in June 2010 The recent passing and implementation of the Medicare Modernization Act created permanent changes to the Medicare supplement plans insurance companies can offer after June 1, 2010. Plans A, B, C, D, F, G, K and L offer nearly the same benefits as before with Plan F now being the most comprehensive. Plans E, H, I, and J have been eliminated. Plans M and N have been introduced as lower priced alternatives requiring some cost sharing for the insured. New Medicare Supplement Coverage Chart

Supplements E, H, I and J Phased OutAs of June 2010, you will no longer be able to purchase Plans J, E, H, and I. They are being phased out and will no longer be for sale by any insurance company as mandated by the Centers for Medicare and Medicaid Services. If you have enrolled in one of these four plans prior to June 1st, then you can keep it if you wish. However, all insurance companies will allow you to convert to any of the new Medicare supplements they offer - like Plan F for instance. It may be wise to strongly consider this conversion opportunity. When your existing coverage (J for instance) is no longer offered, then there will be no new premiums coming in from future customers. This may very well translate to higher than normal renewal premiums for those who choose to keep a discontinued plan. If you wish to convert to a new Modernized plan after your conversion opportunity has passed, then you may have to go through medical underwriting and you could be denied coverage because of poor health. This would not be an issue in some states that offer an open enrollment window each year. However, most states do not provide this opportunity. New Supplements M and N IntroducedMedicare Plans M and N will have more out of pocket expenses for the insured if claims arise. In turn, monthly premiums will be lower for these two plans as compared to some others offering more comprehensive coverage - like Plan F for example. Plans M and N do not cover the Part B deductible or Part B excess amounts. (Not all states allow doctors to charge for Part B excess.) Plan M covers 50% of the Part A deductible while Plan N pays for 100% of this amount. Like Plan M, Plan N pays Part B Coinsurance at 100% except up to a $20 copay for office visits and $50 copay for emergency room visits. Plans K, L, M and N most closely resemble Medicare Advantage insurance coverage. The require more cost sharing for the insured, but they cannot be packaged with prescription Part D drug coverage. As with all Medicare supplements, Part D drug coverage must be purchased as a stand alone product. Should Congress pass health care reform that limits Medicare Advantage coverage, then Plans K, L, M and N may be suitable low cost alternatives. Medicare Insurance Benefit ChangesWhen compared to supplements available prior to June 1st, there are three significant changes to the benefits offered - depending on the coverage you choose. Preventive care not covered by Medicare and at home recovery benefits will no longer be available with the phasing out of Plans E, H, I and J. The rational behind their removal is both benefits were limited in scope, difficult to administer, and not often used by consumers. In their stead, The CMS introduced an added Part A hospice coinsurance benefit that is a core component of all new plans. This is also a limited benefit as hospice coverage was already part of the basic benefits offered by Medicare, but it does close the small gap in coverage. Lower Rates on New SupplementsNot all companies have been approved to offer new Medigap supplemental coverages yet in the states where they do business. However, one of the advantages associated with the Modernization Act should be lower monthly rates for those who choose a conversion plan and for those who are healthy enough to be underwritten for new insurance coverage. When new plans are introduced they will almost always offer lower rates than their predecessors. There are a couple of factors that account for this, but the primary issue is there are no claims associated with a brand new plan. The longer a plan has been in existence, the more claims the insurance company will experience, and in turn they will increase rates for the pool of insured customers. |

|

|

|  |